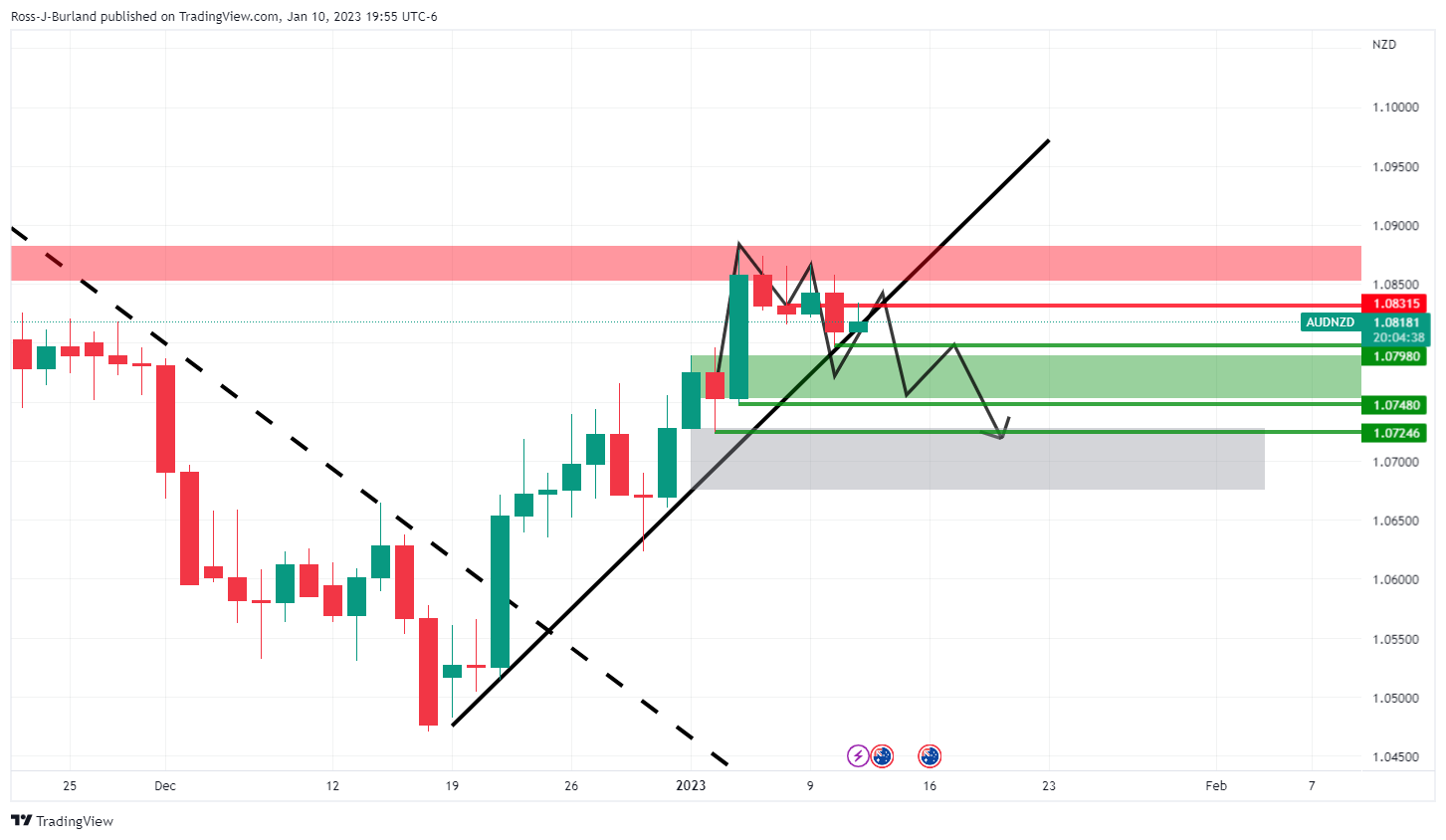

AUD/NZD: Bears move in on critical trendline support

- AUD/NZD is embarking on a test and break of the trendline support despite a hot Aussie data dump.

- The M-formation is a topping pattern and the resistance is so far holding up at the neckline of the pattern near 1.0830.

A break of 1.08 the figure opens the risk of a move to test 1.0750 and then the 1.0720s.

AUD/NZD is flat on the day despite the surprising string Aussie data from earlier in the session. The initial pop in the Aussie was faded and the bears remain on top. at the time of writing, AUD/NZD is trading at 1.0816 and has travelled within a 1.0809 and 1.0834 range so far.

Australia's Retail Sales and the monthly Consumer Price Index indicator fell in at the same time as follows:

- Australia Retail Sales MoM Nov: 1.4% (est 0.6%, prev -0.2%).

- Australia CPI YoY Nov: 7.4% (est 7.2%, prev 6.9%) - Australia Trimmed Mean YoY Nov: 5.6% (est 5.5%, prev 5.3%).

Subsequently, AUD/USD rallied some 20 pips before meeting resistance through 0.69 the figure at 0.6913. This led to a drop in AUD/NZD and the pair is back testing the daily trendline support as the following technical analysis illustrates:

AUD/NZD price analysis

The above chart is of the daily time frame and it shows that the price is embarking on a test and break of the trendline support. The M-formation is a topping pattern and the resistance is so far holding up at the neckline of the pattern near 1.0830.

A break of 1.08 the figure opens the risk of a move to test 1.0750 and then the 1.0720s.