Back

11 Jan 2023

Natural Gas Futures: Extra losses appear favoured in the short term

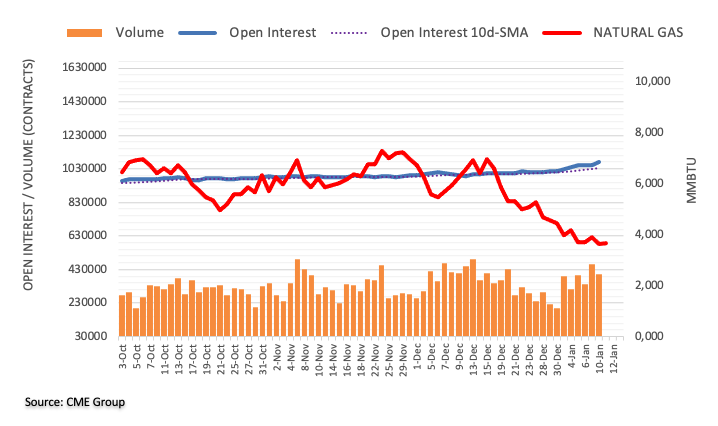

CME Group’s flash data for natural gas futures markets showed another daily build in open interest on Tuesday, now by around 16.6K contracts. On the other direction, volume shrank by nearly 60K contracts, extending the ongoing choppiness.

Natural Gas: Key support emerges at $3.50

Tuesday’s marked retracement in prices of the natural gas was in tandem with increasing open interest and is indicative that a deeper drop could lie ahead in the very near term. On this, there is a solid contention region around the $3.50 mark per MMBtu, which exposes further decline in case the commodity clears it.