Back

8 Feb 2023

Crude Oil Futures: Extra gains need further conviction

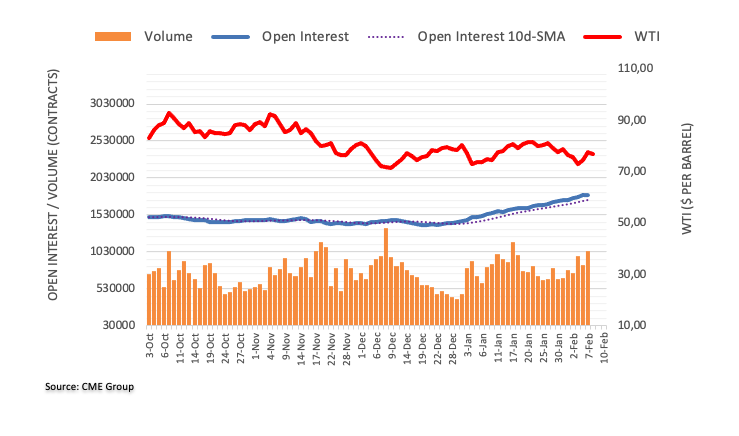

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions by around 6.2K contracts on Tuesday for the first time since January 19. On the other hand, volume remained choppy and went up by around 183.5K contracts.

WTI: Another visit to the 2023 low is not ruled out

Tuesday’s marked uptick in prices of the WTI was amidst shrinking open interest, which warns against the continuation of the recovery at least in the very near term. That said, a corrective move to the YTD low near the $72.00 mark per barrel should not be ruled out for the time being.