NZD/USD Price Analysis: Bulls eye a move out of consolidation to 38.2% Fibo

- NZD/USD is coiled and due for a breakout.

- NZD/USD 4-hour schematic is bullish above 0.6320.

NZD/USD is stuck in consolidation between 0.6350 and 0.6270, but a breakout is inevitable and the question is, in what direction? Coiled markets tend to move in an explosive fashion and we are well into the week yet we are yet to move in a meaningful direction ever since the Nonfarm Payrolls blow-off.

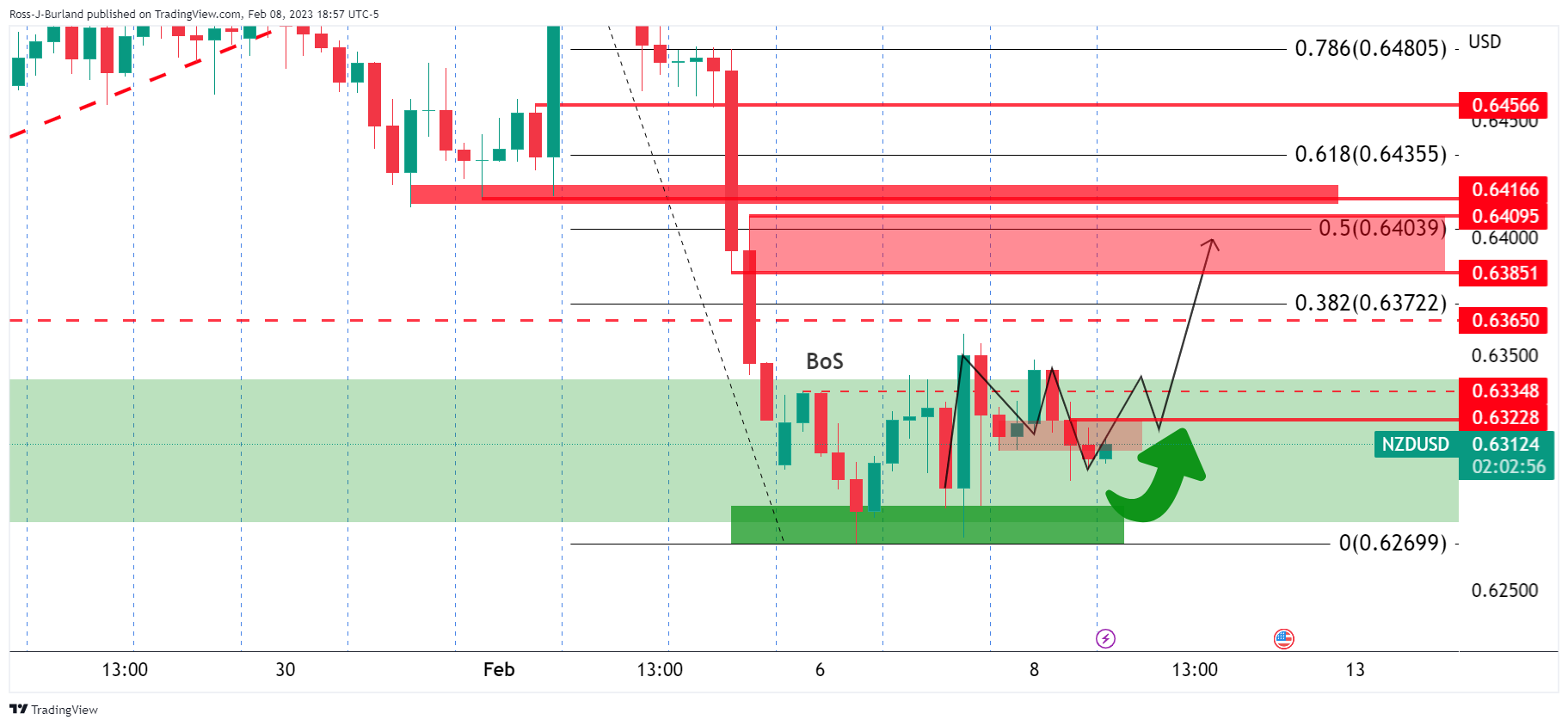

The following illustrates the prospects of a deeper correction into at least the 38.25 Fibonacci retracement of the NFP sell-off:

NZD/USD daily charts

The price is on the backside of the bullish daily trend but is being supported, although the downside bias for the medium term is solidified considering the break of structure 0.6365.

Zoomed in ...

However, as seen the bears can't shake off the bulls that have defended this area of support:

If we are going to see a move, it could come sooner than later with 0.6370 eyed in a 38.2% Fibonacci retracement:

NZD/USD H4 chart

Meanwhile, the 4-hour schematic is bullish above 0.6320: