US Dollar tumbles to 96.80 post-US data, daily lows

The greenback has quickly abandoned the area of daily tops when tracked by the US Dollar Index, coming down to the 96.80 region after advancing to 97.15.

US Dollar weaker on data

The index quickly dropped below the 97.00 handle after US durable goods orders disappointed expectations once again in May. This time headline sales contracted at a monthly 1.1% and expanded 0.1% excluding the Transportation sector.

In addition, the Chicago Fed National Activity Index dropped to -0.26 in May from April’s 0.57.

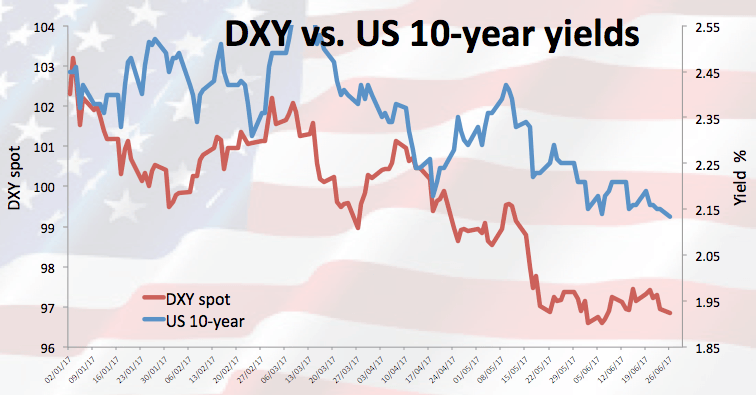

The sharp move lower in US yields collaborated with DXY’s decline, with the 10-year benchmark falling to sub-2.13% levels from earlier tops beyond 2.16%.

Further news around the buck showed net longs have retreated to the lowest level since mid-June 2016 during the week ended on June 20, as per the latest CFTC report.

US Dollar relevant levels

The index is losing 0.14% at 96.84 and a breach of 96.81 (hourly low Jun.26) would open the door to 96.31 (2017 low Jun.14) and finally 95.91 (low Nov.9 2016). On the other hand, the next hurdle is located at 97.15 (high Jun.26) followed by 97.56 (high Jun.15) and then 97.63 (38.2% Fibo of the May-June drop).