EUR futures: consolidative near term

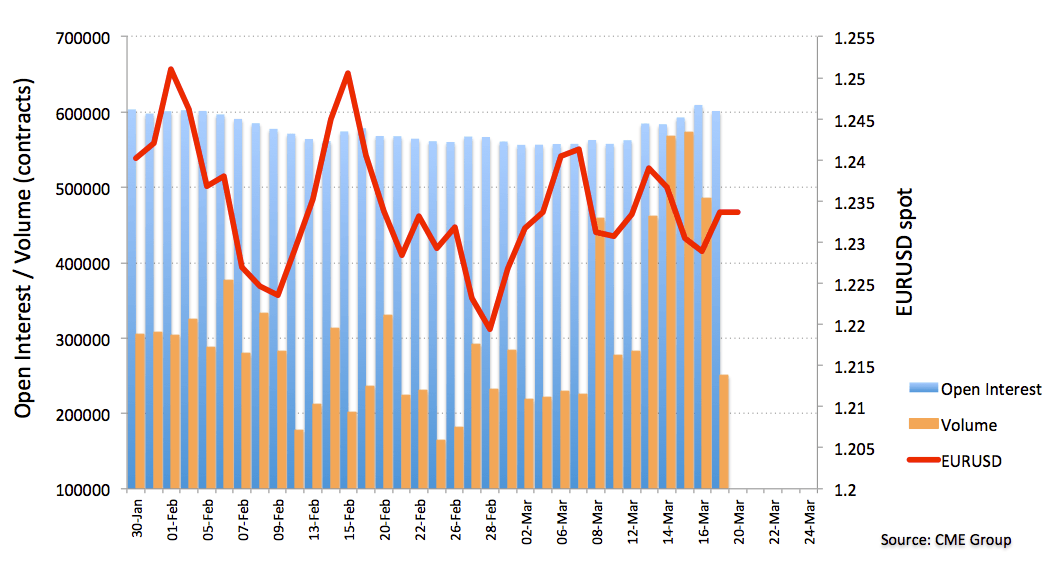

CME Group’s advanced figures for EUR futures markets saw investors scaled back their open interest positions by around 8K contracts on Monday vs. Friday’s final 609,396 contracts. In the same line, volume decreased sharply for the second straight day, this time by more than 235K contracts – the largest drop so far this month.

EUR/USD sidelined ahead of FOMC

EUR/USD managed to rebound from recent lows in the mid-1.2200s to levels beyond the key 1.2300 handle, although the bullish attempt seems to have found strong resistance in the 1.2360 region for the time being. The recent uptick has been in tandem with decreasing open interest and volume, removing tailwinds from the potential continuation of the up move and leaving spot exposed to further rangebound ahead of the critical FOMC meeting due tomorrow.