EUR/GBP Technical Analysis: Short term support line signals further recovery

- EUR/GBP continues to follow short term upward slopping trend-line around early Tuesday.

- The trend line, at 0.8727 now, supports the pair’s gradual recovery to 0.8790.

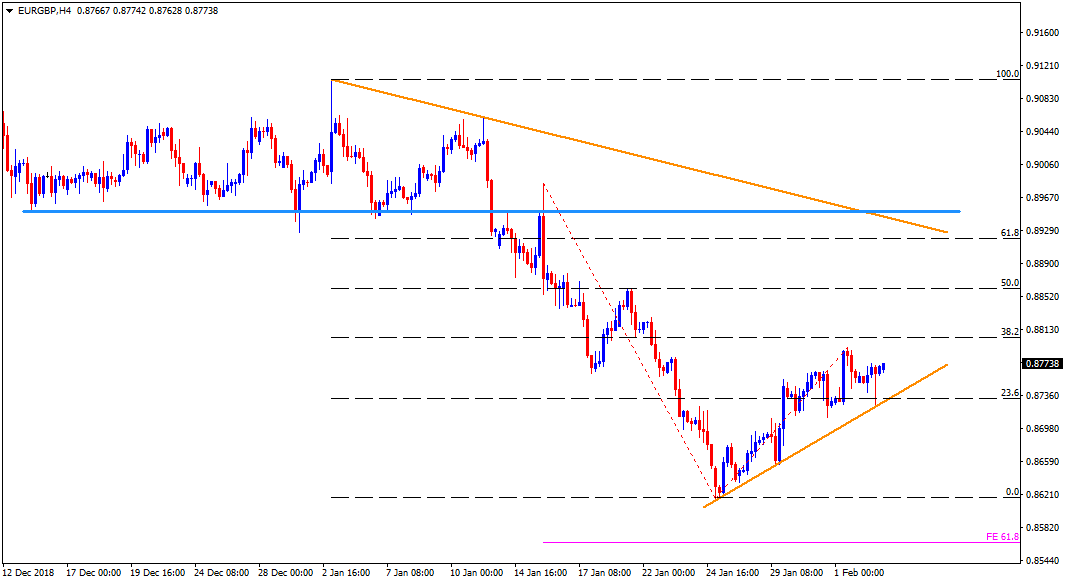

The Euro trades little changed around 0.8770 against the GBP during early Asian market session on Tuesday. The EUR/GBP pair is on recovery mode, as shown via short term support-line, ever since it bounced off the 0.8616 during late January. The 0.8790 and the 0.8835 can act as nearby resistances, in contrast to the 0.8727 and the 0.8680 likely adjacent supports for the pair.

EUR/GBP: Four hour chart

Considering the ten day long upward sloping trend line, the EUR/GBP is expected to recover further towards the 0.8790 and the 0.8835 nearby resistances. However, 50% Fibonacci retracement of its month long decline, at 0.8860 now, might confine the pair’s additional upside.

Given the pair’s successful rise past-0.8860, the 0.8910, the descending resistance-line at 0.8940 and the 0.8950 horizontal-line could challenge the bulls.

On the flipside, the 0.8727 support-line becomes near-term important level for the pair traders to watch, which if broken could drag the quote to 0.8680 level. If at all there prevails extra downside past-0.8680, chances of 0.8616 comeback can’t be denied.

It should also be noted that the 61.8% Fibonacci expansion (FE) around 0.8565 might appear on sellers’ radar once 0.8616 is broken.