Back

11 May 2019

US Dollar Index technical analysis: DXY ends the week above 97.20 support

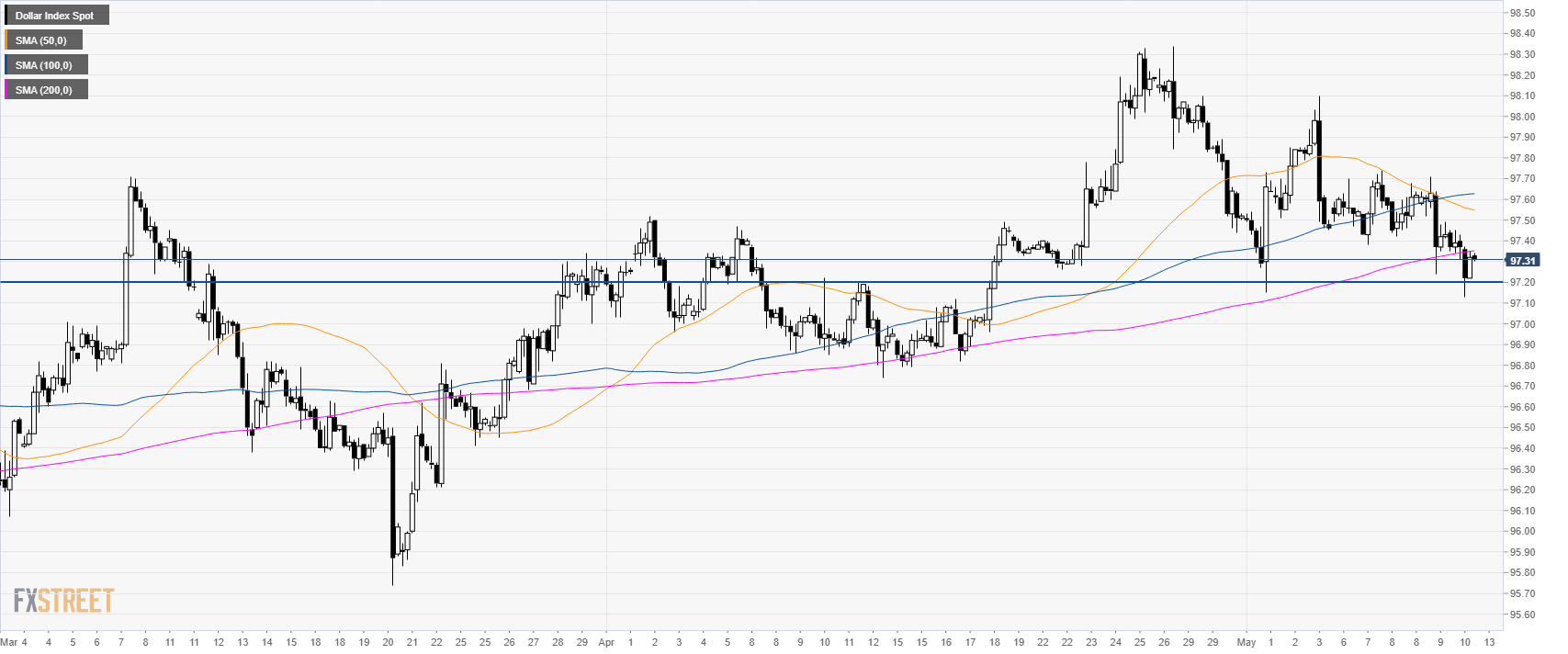

DXY daily chart

The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages (SMAs).

This Friday DXY declined slightly and found some support at the 50 SMA.

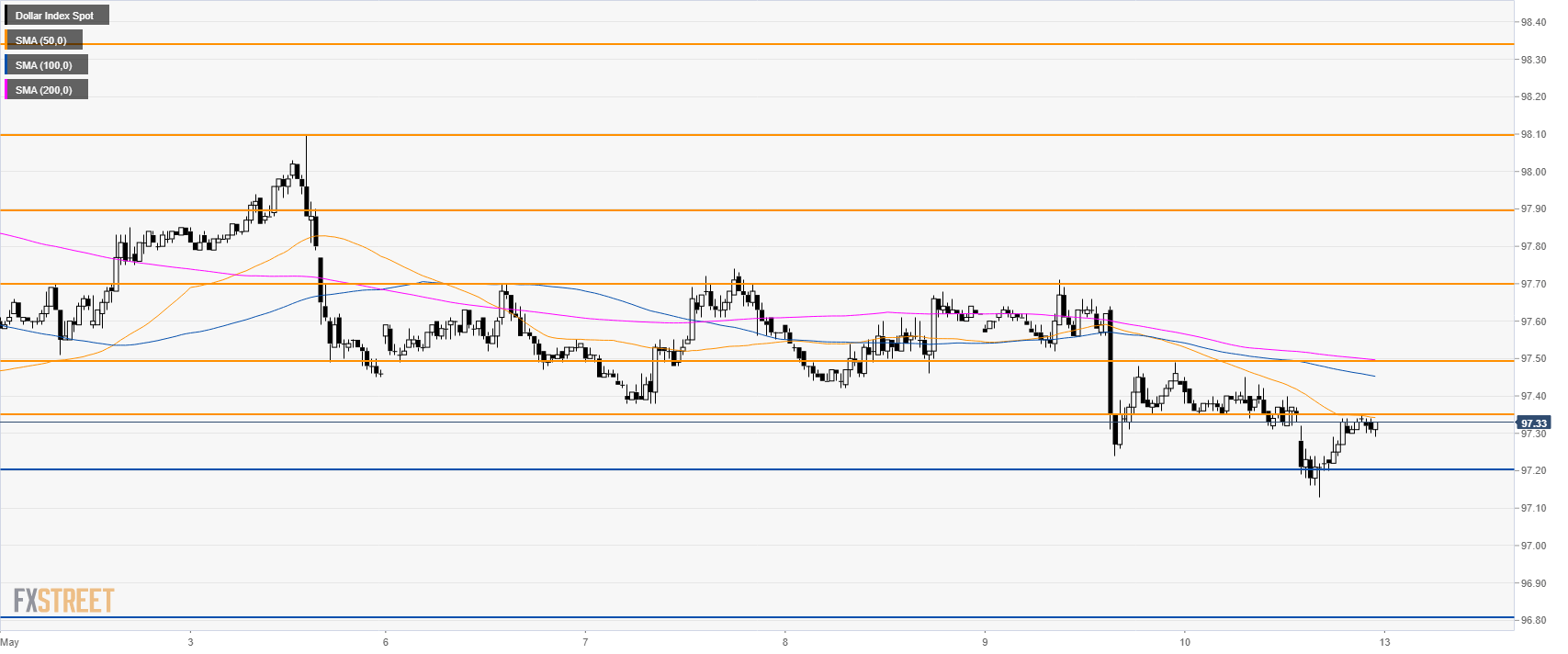

DXY 4-hour chart

DXY trades above 97.20 key support.

DXY 30-minute chart

DXY is trading below its main SMAs suggesting a bearish bias in the short-term.

However, the main trend is up and a bullish break above 97.35 can see a move towards 97.50, 97.70 and 97.90 level.

Support is seen at 97.35 and 97.20 level.

Additional key levels