Back

24 Mar 2020

S&P 500 Asia Price Forecast: Coronavirus relief bill on hold, Fed’s QE game on, US stocks rebound near 2500 level

- S&P 500 is bouncing off 37-month lows and is nearing the 2500 mark.

- Investors are still waiting for the Coronavirus relief bill.

- This Monday, the Fed expanded its Quantitative Easing operation which is the largest stimulus scheme ever created.

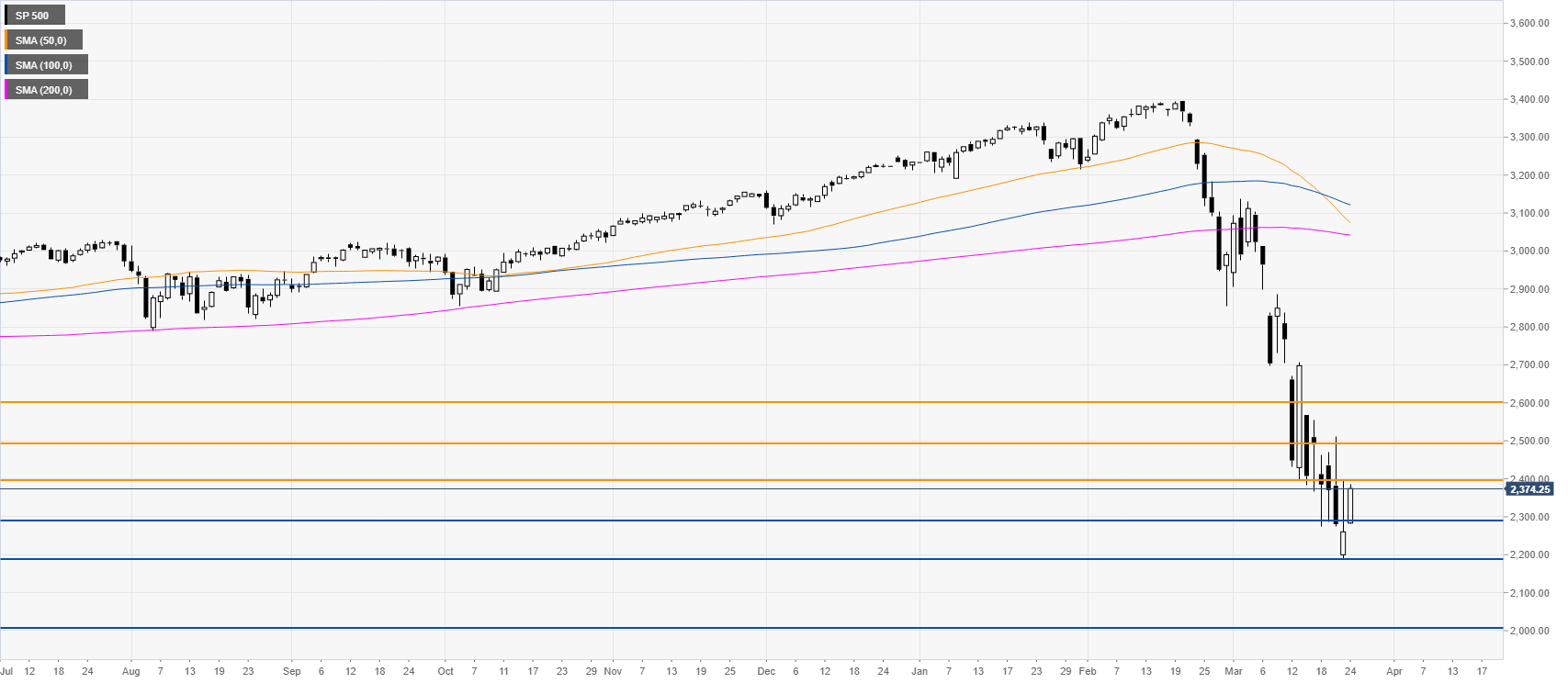

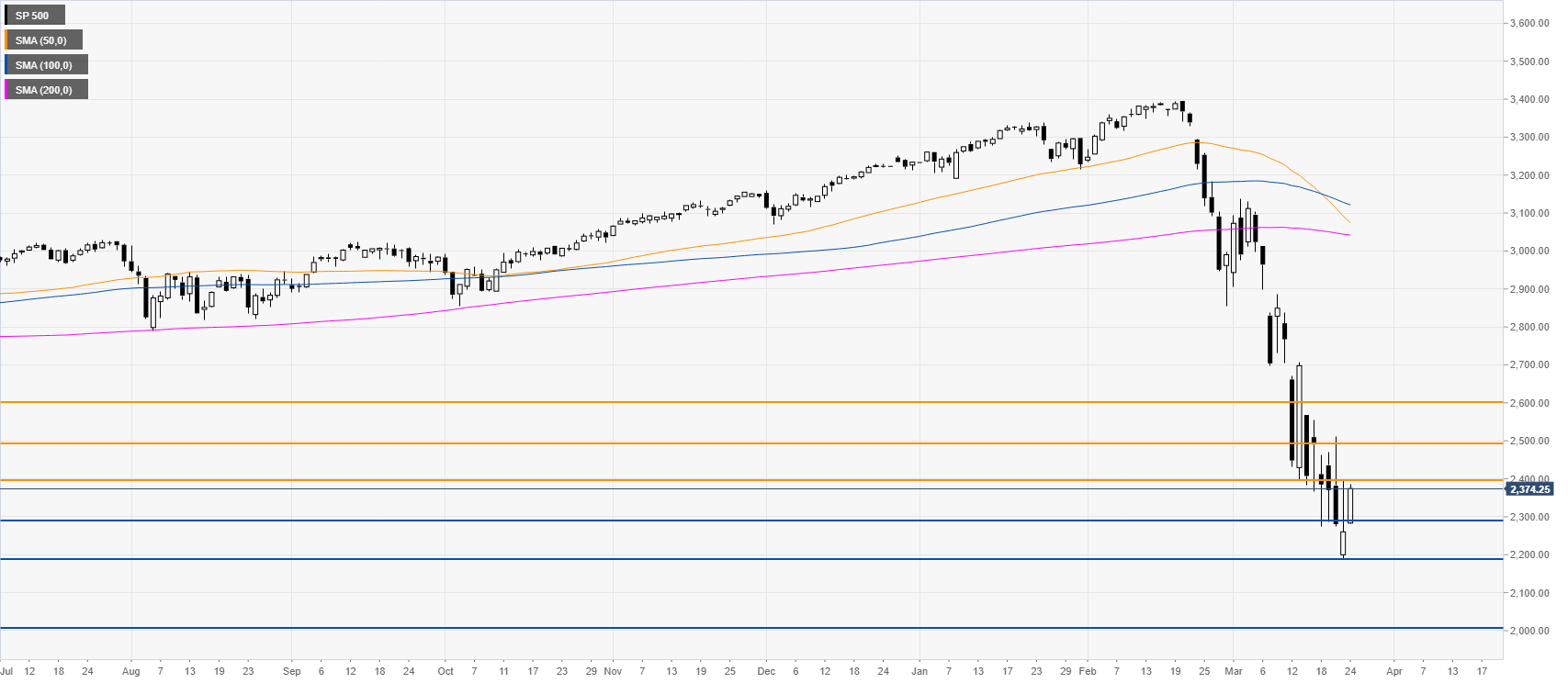

S&P 500 daily chart

The S&P 500 is correcting up after suffering one of the steepest decline in history. The pullback up could extend to the upside especially on a daily close above the 2500 level while resistance can be seen near the 2600 and 2700 figures on the way up. On the other hand, support is seen near the 2300 and 2200 levels. This Monday, the Fed announced that it extended its QE program to counter the harm generated by the coronavirus crisis. Markets have started to react positively however many investors are waiting for the US government's stimulus.

Additional key levels