Back

26 Mar 2020

Gold Futures: Downside seen as shallow

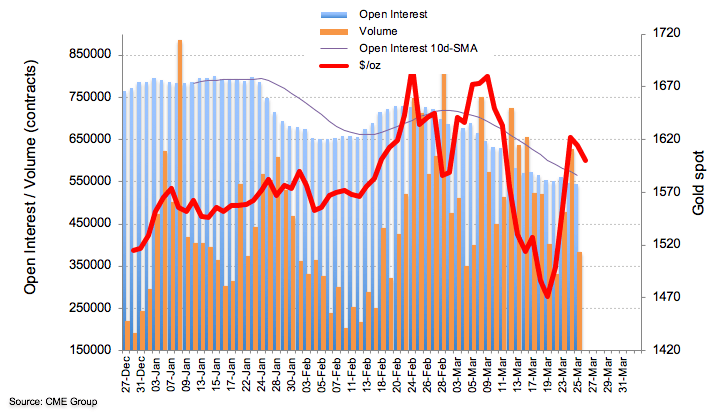

In light of preliminary figures for Gold futures markets from CME Group, traders trimmed their open interest positions for the second day in a row, this time by nearly 3.7K contracts. Volume, in the same line, reversed two straight builds and shrink by around 245.3K contracts.

Gold remains supported near $1,450/oz

Prices of the ounce troy of gold are fading the recent uptick to the $1,650 region. Wednesday’s pullback was on the back of shrinking open interest and volume, which should leave the downside somewhat limited in the short-term horizon.