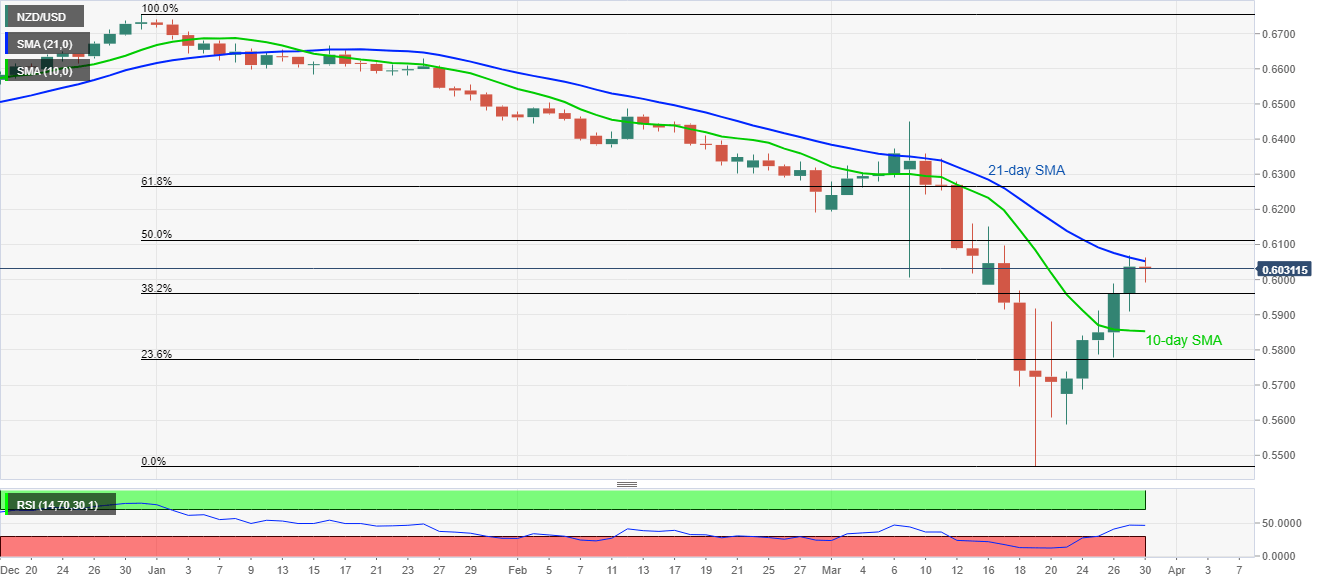

NZD/USD Price Analysis: Remains below 21-day SMA after RBNZ comments

- NZD/USD stays under pressure below the short-term key SMA.

- RBNZ showed readiness to keep the borrowing cost as low for as long as needed.

- 10-day SMA acts as the key short-term support.

Despite staying beyond 10-day SMA, NZD/USD fails to cross 21-day SMA while taking rounds to 0.6035 amid the early Monday’s trading session.

On the fundamental side, the latest comments from the RBNZ Governor Philip Lowe indicated the bank’s readiness to take further measures to combat the coronavirus (COVID-19) pandemic.

Read: RBNZ: Says have other tools at ready to keep cost of borrowing low for as long as needed

That said, the pair might take clues from the recovery in RSI conditions as well as the broad US dollar weakness to clear a 21-day SMA level of 0.6055.

As a result, 50% Fibonacci retracement of the present year’s fall, near 0.6110 and March 02 low near 0.6195 could gain the buyers’ attention.

On the contrary, a 38.2% Fibonacci retracement level of 0.5960 and a 10-day SMA level of 0.5850 can entertain sellers during the fresh downside.

NZD/USD daily chart

Trend: Pullback expected