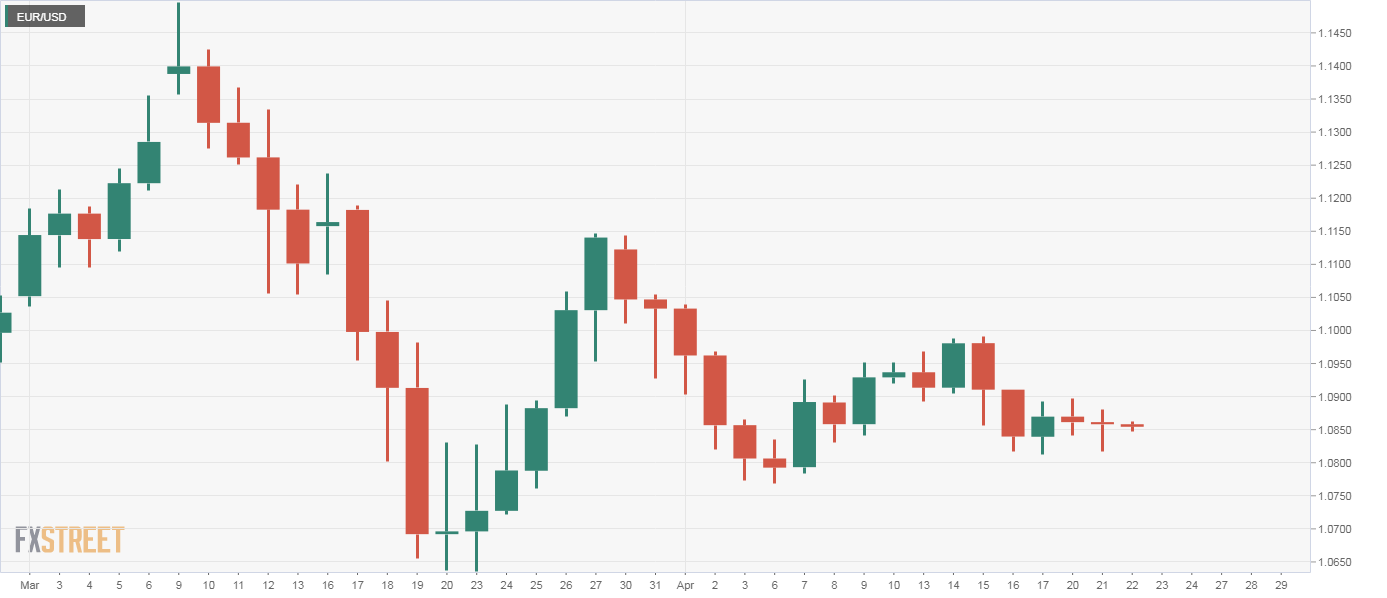

EUR/USD Price Analysis: Market has turned indecisive

- EUR/USD's daily chart is showing signs of indecision in the market place.

- Tuesday's low of 1.0816 is the level to defend for the EUR bulls.

The EUR/USD market is lacking a clear directional bias as suggested by consecutive Doji candles created on Monday and Tuesday.

A Doji candle occurs when an asset sees two-way business during a specific period but ends that period on a flat note. It is widely considered a sign of indecision in the market place, although its effects depend on the context. A Doji after prolonged rally represents buyer exhaustion, while a Doji appearing after a notable sell-off is considered a sign of seller fatigue.

In EUR/USD's case, the consecutive Doji candles have appeared following last Thursday's downside break of the trendline rising from March 3 and April 6 low and indicate indecision among sellers.

As a result, the immediate bearish outlook stands neutralized. A break below the low of Tuesday's Doji candle would revive the bearish view and open the doors to a re-test of the 2020 low of 1.0636.

On the higher side, the high of Monday's Doji candle is the level to beat for the bulls.

Daily chart

Trend: Neutral

Technical levels