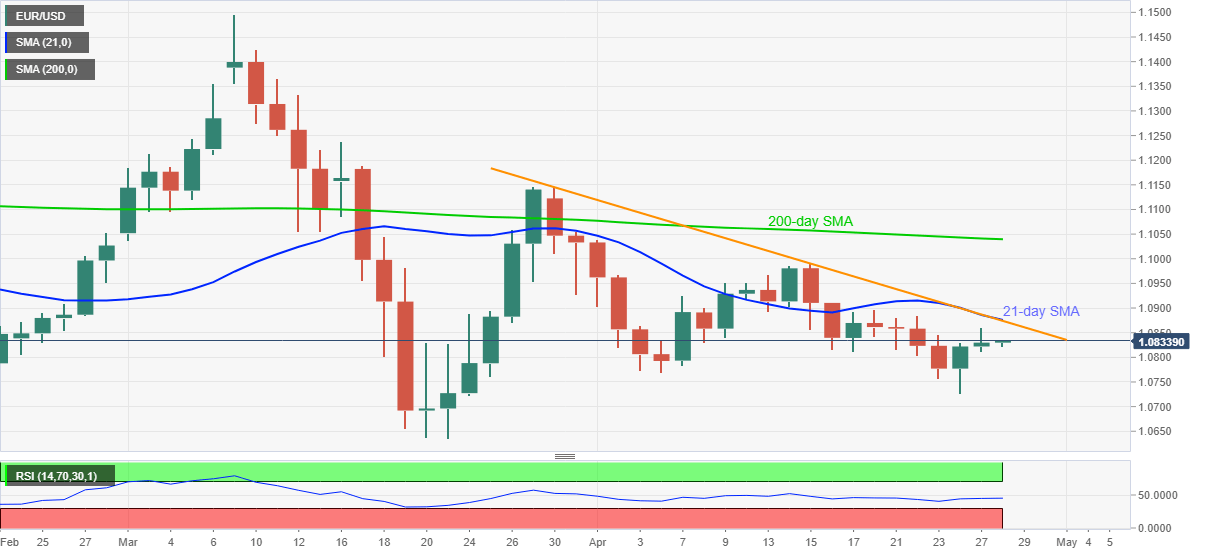

EUR/USD Price Analysis: Mildly bid below 21-day SMA, monthly resistance line

- EUR/USD remains positive for three days in a row.

- Normal RSI conditions, recently weak US dollar favor buyers to challenge strong resistance confluence.

- Sellers will seek entries below the fresh monthly low.

EUR/USD remains on the front-foot while trading around 1.0835 during the early Asian session on Tuesday.

Even if the pair registers a three-day winning streak, it still stays below the near-term key resistance confluence comprising 21-day SMA and a four-week-old falling trend line.

It should, however, be noted that the normal RSI conditions and the US dollar weakness seem to keep the buyers determined to break the 1.0875/80 resistance confluence.

Following that, the mid-month top near 1.0990 and March 27 high close to 1.1150 can lure the bulls.

On the downside, 1.0770 and the monthly low close to 1.0730/25 may entertain sellers during the pair’s pullback.

Though, a clear break below 1.0725 will make the quote vulnerable to drop towards March low around 1.0635.

EUR/USD daily chart

Trend: Further recovery expected