Back

11 May 2020

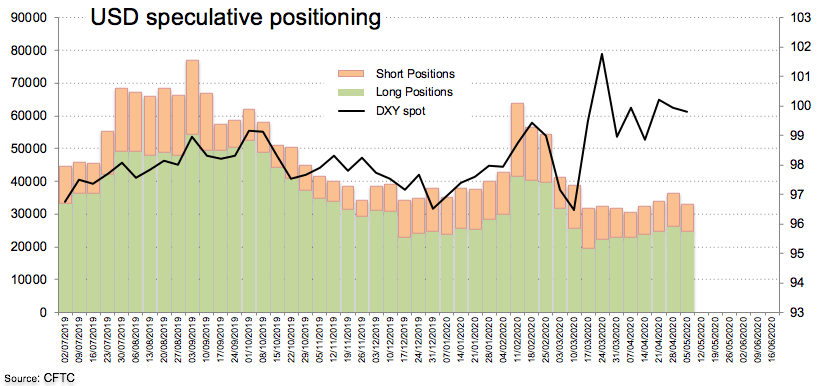

CFTC Positioning Report: USD net longs in 2-month highs

These are the main highlights of the CFTC Positioning Report for the week ended on May 5th:

- Net longs in the dollar edged higher for the seventh week in a row, as investors continued to factor in the re-opening of the economy sooner rather than later, while the recent bias towards the risk aversion showed once again the investors’ preference for the buck.

- Speculators kept adding gross shorts to their positions in the sterling, taking the net shorts to the highest level since December 10th 2019. The broad-based negative view on how the UK government is handling the coronavirus crisis plus prospects of further BoE easing along the road and rising uncertainty surrounding the UK-EU trade negotiations are expected to remain quite a significant drag for the quid in the future.

- Safe heaven demand in combination with expected US-China trade effervescence gave extra legs to the Japanese yen and lifted net longs to 2-week highs.