Silver Price Analysis: XAG/USD still targets $21 amid golden cross, overbought RSI

- Silver outshines gold on Tuesday, hits fresh four-year highs.

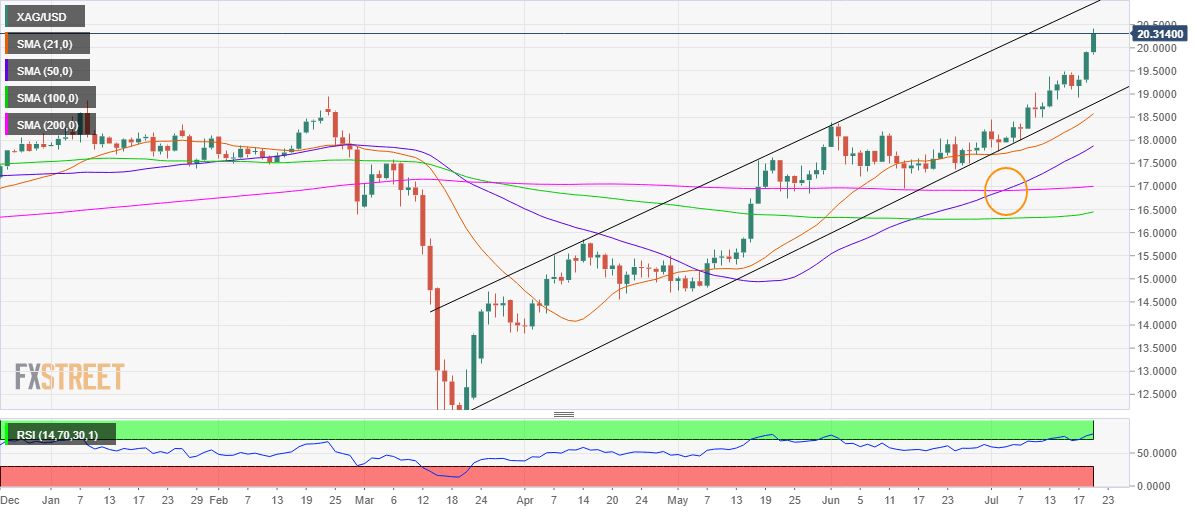

- It trades above all major daily SMAs, within a rising channel.

- Overbought RSI is a cause of concern for XAG bulls.

Silver (XAU/USD) extended its sharp winning streak into a third straight day on Tuesday, reaching the highest level since August 2016 at $20.43 before retracing slightly to $20.25 levels, where it now wavers.

The white metal rallied nearly 50 cents in a matter of minutes, as stops got triggered on a break above the critical $20 barrier. This marks the strongest advance since the parabolic rise in 2011. Silver is tracking the bullish moves seen in Gold, but the pace of increase is much faster in the industrial metal.

Silver: Daily chart

From a technical perspective, despite the upbeat momentum, the price continues to trade within a four-month-long rising channel on the daily chart, having bottomed out in mid-March.

The spot remains on track to test the trendline resistance of the channel, now aligned at $20.96. However, the daily Relative Strength Index (RSI) is in the overbought territory, suggesting a minor correction before the uptrend resumes.

Therefore, any pullbacks will see a test of the resistance-turned-support of the 20 mark, below which last week’s high at $19.48 could be tested.

Further south, Friday’s low and the channel support around $18.93/75 could offer some respite to the bulls.

To conclude, the path of least resistance appears to the upside as long as the price holds above the upward losing 21-DMA at $18.57. Meanwhile, the golden cross spotted in early July also adds credence to the ongoing advance in the metal.

Silver: Additional levels