USD/CHF Price Analysis: The pair looks to be heading to some key supports on the weekly timeframe

- USD/CHF trades another 0.28% lower on Wednesday.

- There are some key levels close by from the weekly timeframe.

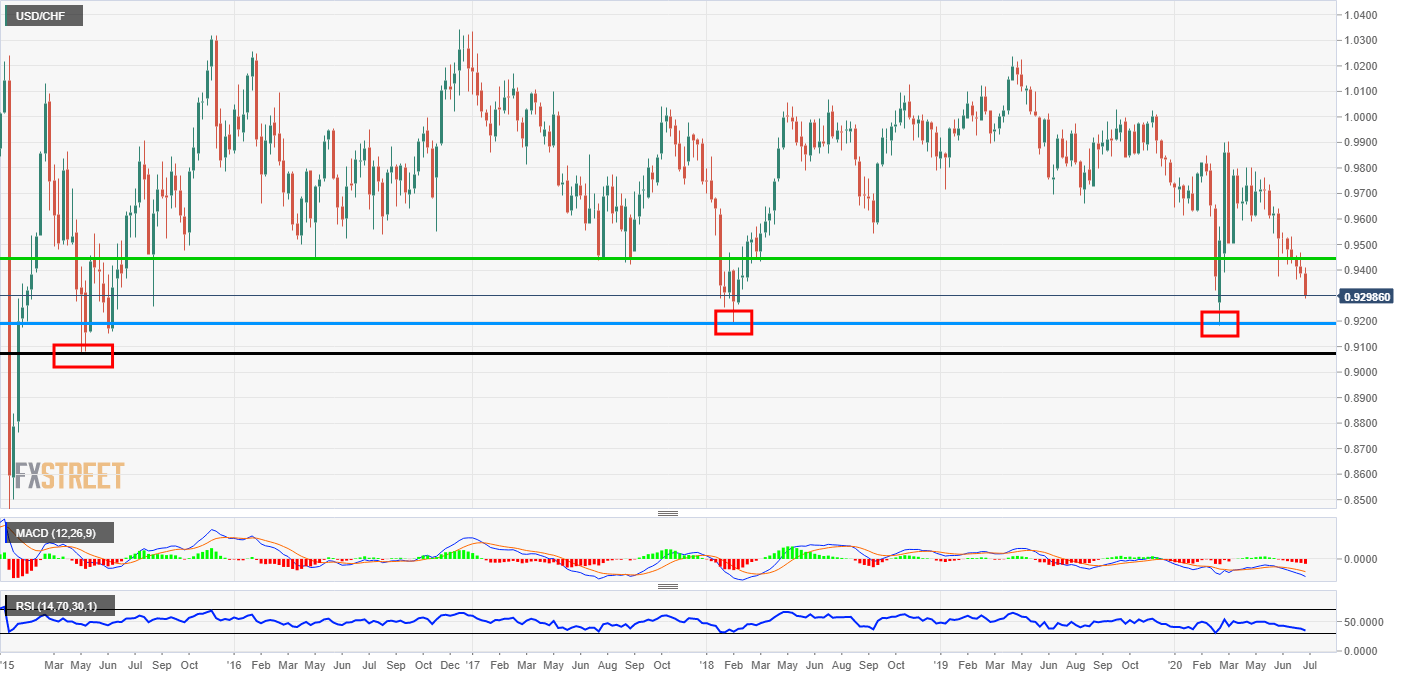

USD/CHF weekly chart

This week could mark the fifth straight weekly decline as the pair has started the week on the back foot once again. Just two weeks ago now the price broke the 0.9450 support area and now it seems there could be some more downside ahead as the price looks to test some more important levels.

The next major zone lies at the psychological 0.92 level and it has been very important in the past. On this chart alone the price has hit the area four times and then found its way higher. Below that, there is also a level just under 0.91 in black and this could be considered the real consolidation low. It is safe to say the dollar is in a strong downtrend and if the coronavirus situation gets worse there could be more pain ahead.

Looking at the indicators, the Relative Strength Index is just nearly touching the oversold 30 point. There is still lots more room on the downside. The MACD histogram is firmly in the red and the signal lines are also pretty depressed. The question remains if the SNB would be willing to act if the CHF gets too strong. EUR/CHF is still pretty weak at the moment but over the last eight sessions, there has been an uptick in the pair.

Additional levels