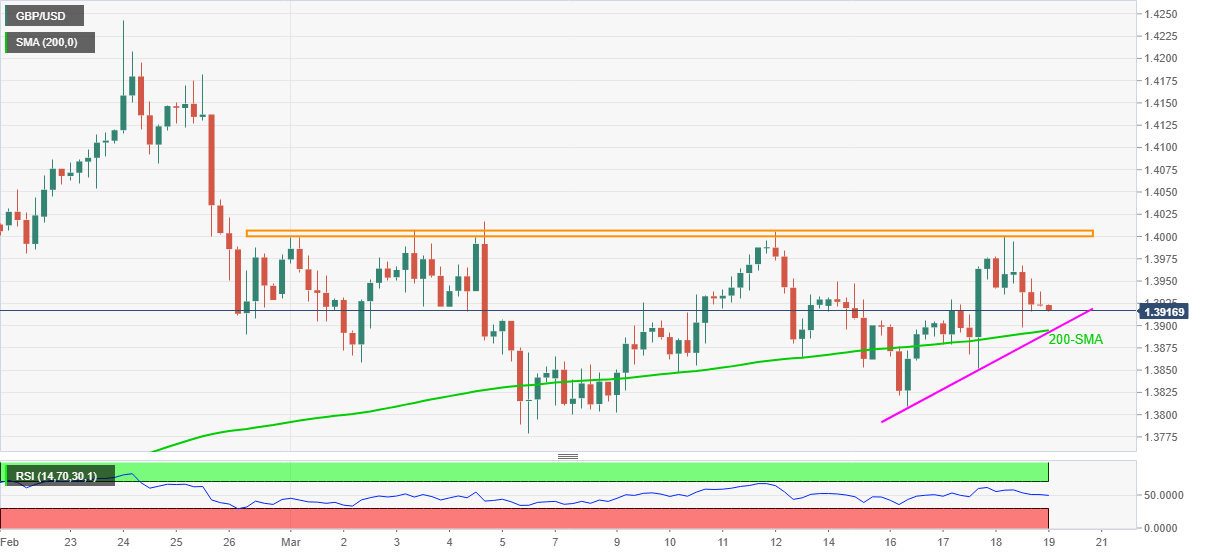

GBP/USD Price Analysis: Drops towards 1.3900 after another failure to cross monthly hurdle

- GBP/USD stays depressed after fifth rejection from the key resistance.

- 200-SMA, three-day-old rising trend line probe short-term sellers.

- Downward sloping RSI favor sellers, bulls have a bumpy road beyond 1.4000.

GBP/USD extends the previous day’s weakness while declining to 1.3917, down 0.05% intraday, during Friday’s Asian session. In doing so, the quote justifies the pullback from a horizontal area comprising multiple tops marked since March 01.

Also favoring the cable sellers could be the downward sloping RSI and multiple barriers to the north, beyond the stated horizontal hurdle.

With this in mind, GBP/USD sellers are currently ragging to battle the 200-SMA and short-term support line, around 1.3900, a break of which will direct the bears toward the monthly low near 1.3790.

Meanwhile, the corrective pullback may eye 1.3980 but bulls are less likely to take risk ahead of witnessing a clear break of 1.4010.

Also challenging the GBP/USD buyers past-1.4010 will be February 24 low near 1.4085 and the previous month’s peak surrounding 1.4245.

To sum up, GBP/USD is up for a fresh bearish move but awaits a clear break of immediate support.

GBP/USD four-hour chart

Trend: Further weakness expected