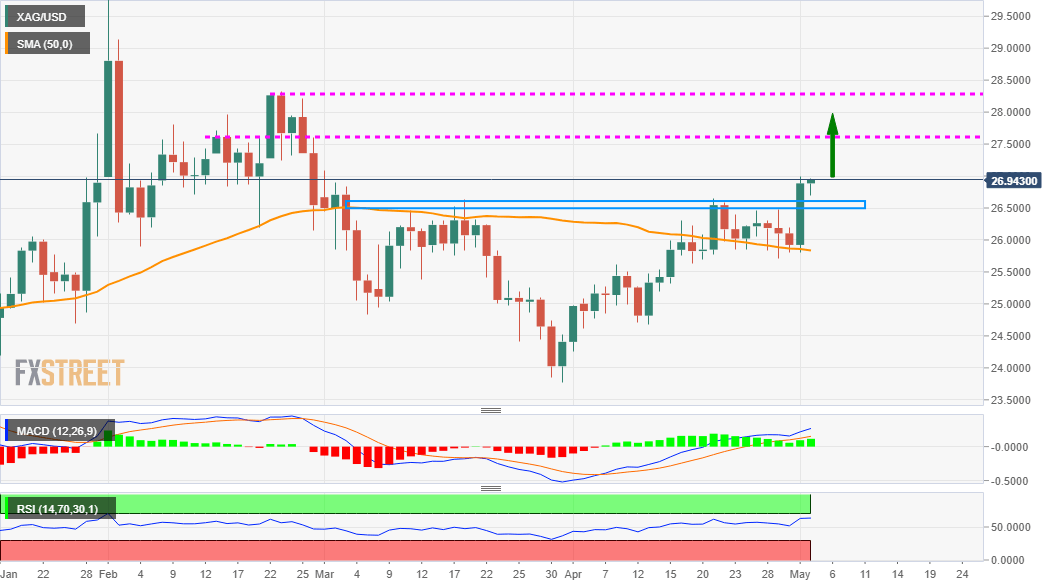

Silver Price Analysis: XAG/USD bulls await a sustained move beyond $27.00 mark

- Silver attracted some dip-buying on Tuesday and held steady near two-month tops.

- The technical set-up favours bullish traders and support prospects for additional gains.

- Only a sustained break below the $26.00 mark will negate the constructive outlook.

Silver reversed an intraday dip to the $26.70 region and refreshed daily tops during the early North American session. The white metal was last seen hovering near two-month tops, with bulls awaiting a sustained move beyond the $27.00 mark.

From a technical perspective, the overnight sustained move beyond the $26.50-60 supply zone confirmed a near-term bullish breakout. This, along with the emergence of some dip-buying on Tuesday, supports prospects for additional near-term gains.

Meanwhile, technical indicators on the daily chart maintained their bullish bias and are still far from being in the overbought territory. This further validates the constructive set-up and a possible move towards the next hurdle near mid-$27.00s.

Some follow-through buying should pave the way for an extension of the recent bounce from YTD lows and assist the XAG/USD bulls to aim back to reclaim the $28.00 round-figure mark. This is followed by resistance near the $28.30-35 region.

On the flip side, the $26.60-50 resistance breakpoint now seems to protect the immediate downside. Any further pullback might now be seen as a buying opportunity near the $26.30-25 region. This, in turn, should help limit the downside near the $26.00 mark.

A convincing breakt hrough the mentioned support levels will negate the positive outlook and prompt some aggressive technical selling. The XAG/USD might then turn vulnerable to accelerate the fall towards challenging the key $25.00 psychological mark.

XAG/USD daily chart

Technical levels to watch