US Dollar Index looks bid and tests 92.00 ahead of data

- DXY extends the upside and revisits the 92.00 area.

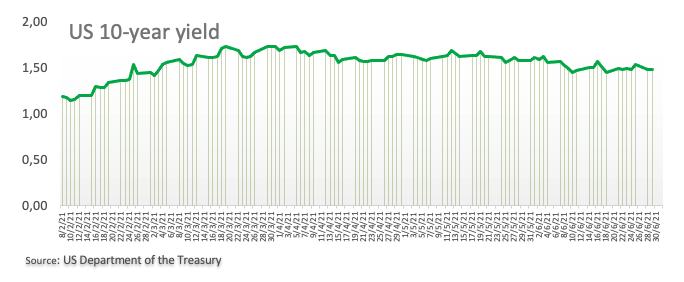

- US 10-year yields remain muted just below the 1.50% level.

- Housing data, CB’s Consumer Confidence next on tap.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main rivals, attempts to break the recent consolidative range and moves to the 92.00 neighbourhood.

US Dollar Index bid ahead of US docket

The index now advances for the fifth consecutive session and regains the 92.00 area on the back of the soft note in the risk complex and in spite of the flat performance of US 10-year yields.

Indeed, yields of the key US 10-year benchmark remain flat in the 1.50% zone, so far extending the multi-session rangebound theme.

Looking at the broader picture, investor remain cautious and trade conditions remain flat ahead of the critical release of the June’s Nonfarm Payrolls later in the week.

In the docket, the housing sector will be in the limelight in the first turn, as the House Price Index measured by the FHFA and the S&P/Case-Shiller Index are due ahead of the key Consumer Confidence tracked by the Conference Board and the weekly report on crude oil supplies by the API.

In addition, Richmond Fed T.Barkin (voter, centrist) is due to speak.

What to look for around USD

The dollar attempts to regain the 92.00 yardstick while remains well supported by the key 200-day SMA. The likeliness that the tapering talk could kick in before anyone had anticipated and a potential rate hike in H2 2022 fuelled the sharp bounce in the buck post-FOMC event to levels last seen in mid-April and at the same time introduced some uncertainty into the debate surrounding the extension of the “transient” inflation. The strong upside in DXY was also supported by higher yields in the shorter end of the curve, which in turn widened the spread differential vs. their German peers. In the meantime, further progress on the reopening of the economy, the vaccine rollout and results from key fundamentals remain key for the dollar’s price action/sentiment in the short-term horizon.

Key events in the US this week: House Price Index, Conference Board’s Consumer Confidence (Tuesday) – MBA Mortgage Applications, ADP Report, Pending Home Sales (Wednesday) – Initial Claim, ISM Manufacturing PMI, Markit’s June final Manufacturing PMI (Thursday) – Nonfarm Payrolls, Unemployment Rate, Balance of Trade, Factory Orders (Friday).

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families, worth nearly $6 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is gaining 0.16% at 92.03 and a breakout of 92.40 (monthly high Jun.18) would open the door to 92.46 (23.6% Fibo level of the 2020-2021 drop) and finally 93.43 (2021 high Mar.21). On the downside, initial contention emerges at 91.51 (weekly low Jun.23) followed by 91.15 (100-day SMA) and finally 89.53 (monthly low May 25).