Gold Price Forecast: XAU/USD bears look to $1,758, ECB PEPP verdict in focus

- Gold remains pressured for fourth consecutive day, extends downside break of the key technical support levels.

- Fed tapering woes, virus-led economic fears and stimulus chatters keep bears hopeful.

- ECB may curtail pandemic reliefs but statements are the key.

- European Central Bank Preview: Taper on the table, but don’t get too excited about it

Gold (XAU/USD) justifies the technical breakdown amid sour sentiment during early Thursday. That said, the yellow metal holds lower ground near $1,790, the lowest in two weeks by the press time.

While a break of the 200-SMA and a three-week-old support line favor gold sellers, risk-off mood exerts additional downside pressure on the quote ahead of the key European Central Bank (ECB) monetary policy meeting. In doing so, the commodity drops for the fourth day in a row at the latest.

Mainly weighing on the risk appetite are the Fed tapering chatters and economic fears due to the recent rise in the coronavirus numbers. While a jump in the US JOLTS Job Openings to refresh record top helped the Fed policymakers to reiterate their bullish bias, rise in the virus infections challenge the optimists.

St. Louis Fed Bank President James Bullard and New York Fed Bank President John Williams backed tapering in 2021 whereas Dallas Federal Reserve Bank President Robert Kaplan makes the case for an October taper despite cutting on Q3 GDP due to covid. It’s worth observing that Australia reports the second day of increase in covid cases whereas China also marked an uptick in the COVID-19 numbers. On Wednesday, the US, Germany and the UK also marked an increase in daily covid cases.

The doubts over US President Joe Biden’s six-pronged strategy, up for publishing on Thursday, joins the US diplomat’s mixed view on Jerome Powell’s reappointment as the Fed Chairman to also weigh on the sentiment. Further, signals from Republicans and some of the Democratic Party members to offer a bumpy road to the US stimulus also spoiled the mood.

While portraying the mood, the S&P 500 Futures drop 0.17% intraday but the US 10-year Treasury yields remain directionless and so do the US Dollar Index (DXY).

Moving on, the ECB updates will be the key for gold traders to follow whereas the weekly US job numbers, headlines concerning the coronavirus and the US stimulus may also entertain the gold bears.

Although the ECB is widely anticipated to dial back the Pandemic Emergency Purchase Programme (PEPP), comments over the bloc’s economic performance going forward and scope for further tightening of the monetary policy will be the key.

Technical analysis

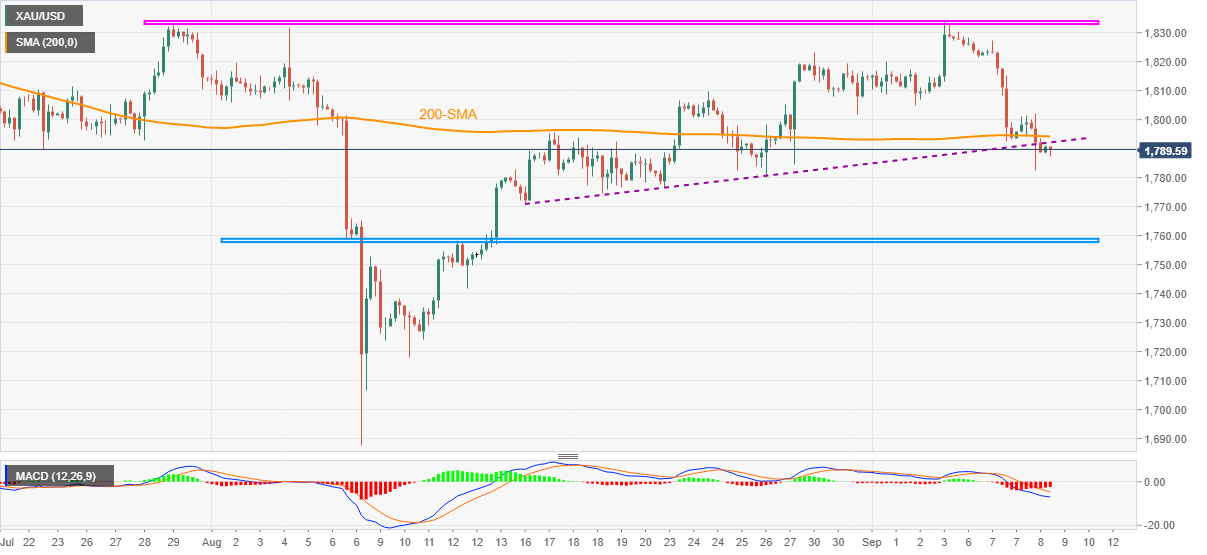

Gold prices stay depressed around a two-week low after breaking 200-SMA and an ascending trend line from August 16.

The breakdown gains acceptance from the bearish MACD signals to direct sellers towards the mid-August lows near $1,770 during the fall to monthly support near $1,758.

It should be noted that the gold bears may find it tough to conquer the stated horizontal support, which if broken will make the metal vulnerable to visit August 10 lows near $1,717 and then the $1,700 threshold.

Meanwhile, the support-turned-resistance line near $1,792, followed by the 200-SMA around $1,795 and the $1,800 round-figure, could challenge the commodity’s recovery moves.

Even if the gold buyers manage to regain the $1,800 mark, a horizontal area surrounding $1,854 becomes the key hurdle to the north.

Gold: Four-hour chart

Trend: Further weakness expected