Back

7 Apr 2022

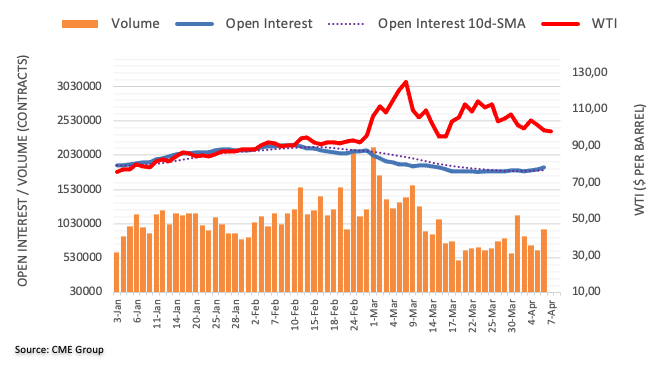

Crude Oil Futures: Rising bets for extra decline

CME Group’s flash data for crude oil futures markets noted traders added around 21.6K contracts to their open interest positions on Wednesday. In the same line, volume reversed three daily pullbacks in a row and went up by nearly 300K contracts.

WTI: Door open to $95.00 and below

Wednesday’s downtick in prices of the WTI was on the back of increasing open interest and volume, leaving room for the continuation of the leg lower in the very near term at least. That said, the $95.00 region per barrel emerges as the next potential target for crude oil prices.