USD/TRY keeps the broader range bound theme post-CBRT

- USD/TRY extends its consolidation on Thursday.

- The CBRT, as expected, left the policy rate intact.

- The pair keeps the 14.50-15.00 range for the time being.

The Turkish lira gives away part of the recent gains and motivates USD/TRY to trade with decent gains in the 14.60 region on Thursday.

USD/TRY remains within the consolidative phase

USD/TRY advances modestly and keep the 14.50-15.00 range well in place for yet another session after the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 14.00%, as widely expected.

There were no meaningful changes to the bank’s statement on Thursday other than the mention of rising uncertainty due to the geopolitical conflict, while supply chain disruptions and higher commodity prices are still seen behind the rise in prices domestically and across the world.

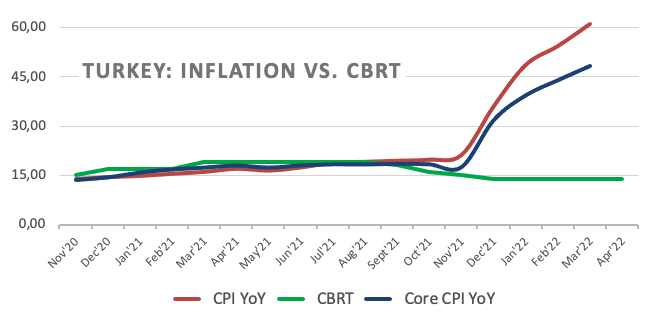

The CBRT emphasized the continuation of the “liraization” strategy as the main way to bring down inflation to the still medium-term target at 5%.

What to look for around TRY

The lira keeps the range bound theme unchanged vs. the greenback, always in the area below the 15.00 neighbourhood for the time being. So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Current Account, Unemployment Rate (Monday) – Industrial Production, Retail Sales (Tuesday) – CBRT Interest Rate Decision (Thursday) – Budget Balance (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 0.17% at 14.6152 and faces the next hurdle at 14.9889 (2022 high March 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a drop below 14.6150 (monthly low April 1) would expose 14.5136 (weekly low March 29) and finally 14.1965 (55-day SMA).