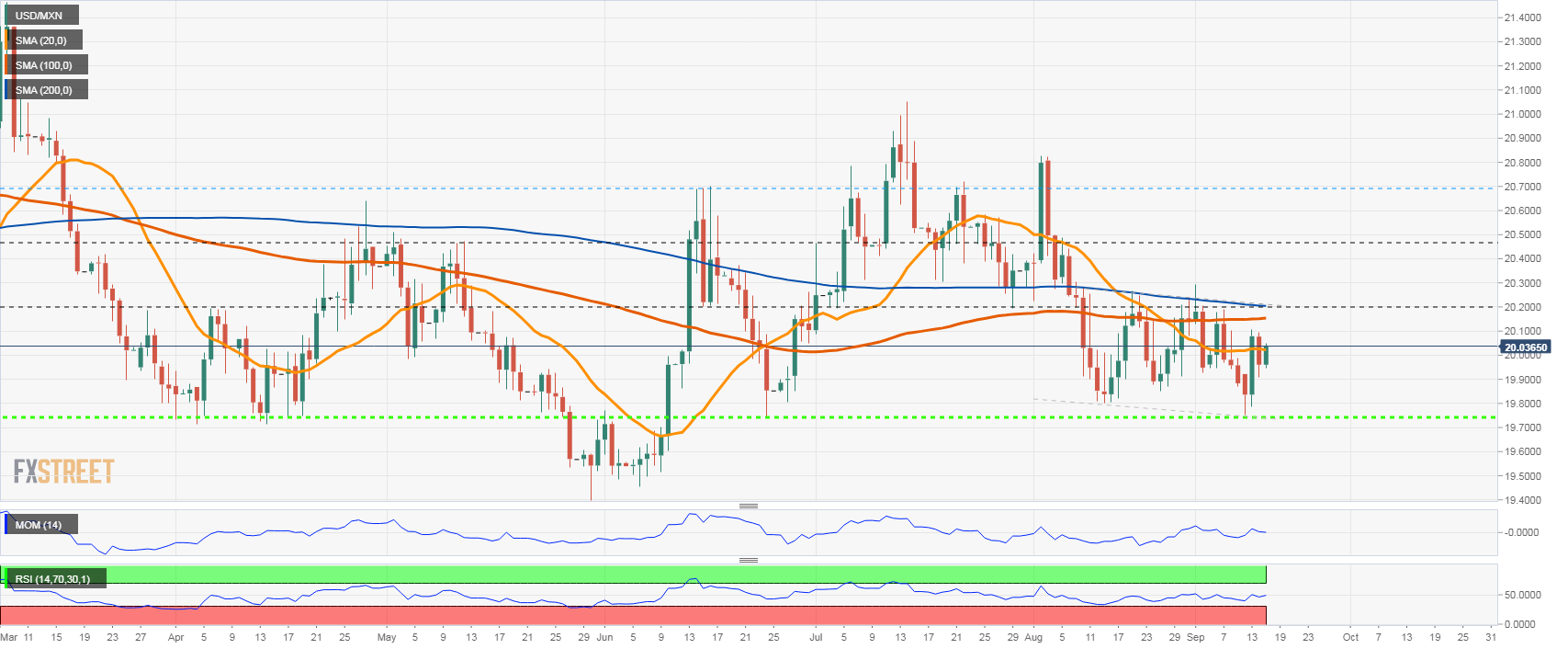

USD/MXN remains in range, looking at 20.10 as market sentiment deteriorates

- USD/MXN moving between 20.20 and 19.80 since mid-August.

- Mexican peso fails to break 19.80, and reverses.

- Stocks turn lower in Wall Street, supporting the dollar.

The USD/MXN is up on Thursday amid a stronger US dollar across the board. The pair is trading at 20.07, at the highest intraday level. Wall Street is turning from neutral to bearish, favoring the greenback.

On the upside, the immediate resistance is seen at 20.10 (Sep 8 and 13 high). A consolidation above could point to further gains and a test of the critical area between 20.17 and 20.20. A daily close above 20.20 would be a positive technical development suggesting more gains ahead, targeting the 20.45 area.

On the flip side, the first support stands at 19.95, but a more significant barrier is located at 19.90. The key area is 19.80 and a break lower would put USD/MXN on its way toward 19.70.

Eyes on the Fed

Following many US economic reports (jobless claims, retail sales, Philly Fed and industrial production) on Thursday and particularly the CPI on Tuesday, attention now sets on the FOMC meeting next week. The central bank is expected to raise interest rates by 75 basis points on Wednesday. Banxico is expected to follow on September 29.

USD/MXN daily chart

Technical levels